Quality Jobs

PROGRAM OVERVIEW

The primary goal of the Quality Jobs tax credit (A.R.S. § 41-1525) is to encourage business investment and the creation of high-quality employment opportunities in the state. Quality Jobs accomplishes this goal by providing tax credits to employers creating a minimum number of net new qualifying jobs and making a minimum capital investment in Arizona.

The program is capped at 10,000 jobs being Pre-Approved each year. To view the amount of available credits, please download the Tax Credit Allocation Table.

The Quality Jobs tax credit offers up to $9,000 of Arizona income or premium tax credits spread over a three-year period for each net new qualifying job ($3,000 per year). The program encourages continuous employment; therefore, the tax credit is equal to:

| Years of Employment | Tax Credit Amount |

|---|---|

|

First year: |

$3,000 per net new qualified employment position created during the taxable year or partial year of employment. |

|

Second year: |

$3,000 per qualified employment position, employed for the second full taxable year of continuous employment. |

|

Third year: |

$3,000 per qualified employment position, employed for the third full taxable year of continuous employment. |

If the allowable tax credit exceeds the income or premium tax liability, any unused amount may be carried forward for up to five consecutive taxable years.

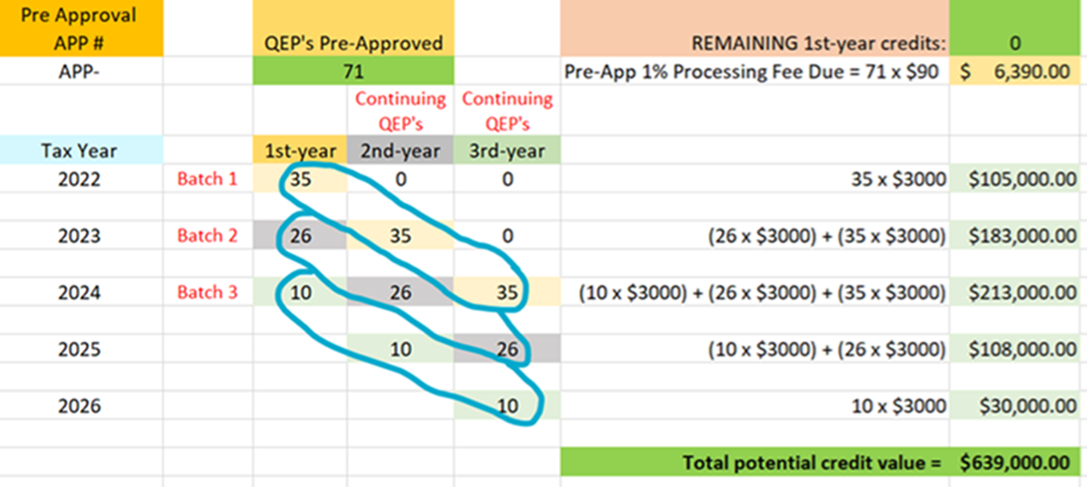

Below is a diagram indicating the potential maximization of program credits.

Any company making the minimum capital investment in Arizona and creating the minimum net new qualifying jobs can apply. Eligibility qualifications are different for rural and urban areas and are described in the chart below. A taxpayer is eligible to claim Program credits once, within a 12-month period the Taxypayer, (i) makes the requisite minimum investment, and (ii) creates the requisite minimum number of new qualifying jobs.

| Minimum Capital Investment | Minimum Number of Net New Jobs (QEP's) Added | Percent of County Median Wage | ||||||

|---|---|---|---|---|---|---|---|---|

| For Urban Locations: | ||||||||

| $5,000,000 | 25 | 100% | ||||||

| $2,500,000 | 25 | 125% | ||||||

| $1,000,000 | 25 | 150% | ||||||

| $500,000 | 25 | 200% | ||||||

| For Rural Locations: | ||||||||

| $1,000,000 | 5 | 100% | ||||||

| $500,000 | 5 | 125% | ||||||

| $100,000 | 5 | 150% | ||||||

Urban Area – A location that is within the exterior boundaries of a city or town that has a population of 50,000 or more, and that is located in a county that has a population of 800,000 or more.

Rural Area – A location that is within the boundaries of tribal lands or a city or town with a population of less than 50,000, or a county with a population of less than 800,000.

To begin an application, please login to the EASY Portal or click here to request a username/password.

Applying for Pre-Approval:

The Quality Jobs pre-application indicates a taxpayer’s intended capital investment and hiring expectations at a specific designated location in Arizona over a three year period. The taxpayer must also demonstrate that they will meet the statutory thresholds within a 12-month period. Please note, a taxpayer is not precluded from satisfying the investment and job creation thresholds before submitting a Request for Pre-Approval or before obtaining a Pre-Approval Letter. If approved, the Authority will issue a written Pre-Approval Letter to the applicant identifying the amount of tax credits being reserved for the taxpayer.

Applying for Post-Approval:

The Quality Jobs post-application verifies whether the program requirements were met per the pre-application estimates. Post-applications must include capital investment and employment documentation proving satisfaction of the program investment and job creation requirements. After the close of the taxable year specified in the Pre-Approval Letter the taxpayer must timely report and certify to the Authority that it has satisfied the Program’s requirements via a post-approval application. If the applicant is eligible and approved, the Authority will issue a Tax Credit Allocation Letter to the applicant identifying the credit the taxpayer may be able to claim with the Arizona Department of Revenue or the Arizona Department of Insurance & Financial Institutions, as applicable.

***DEADLINE REMINDER*** per section 6 (B)(C) of the Quality Jobs Tax Credit Program Rules & Guidelines, “For income tax credits, an Application must be filed with the Authority by the earlier of: (i) six months after the end of the taxpayer’s taxable year in which the QEPs were created or (ii) the date the tax return is filed for the taxable year in which the QEPs were created. For premium tax credits, an Application must be filed with the Authority on or by March 1st of the year after the calendar year in which the QEPs were created.

For more detailed information please see below or direct questions to the Program Manager.

The QJTC program is established under A.R.S. § 41-1525

Income tax credits - A.R.S. § 43-1074 or 43-1161

Premium tax credit - A.R.S. § 20-224.03

2014 Legislative Update: House Bill 2272

2017 Legislative Update: Senate Bill 1416